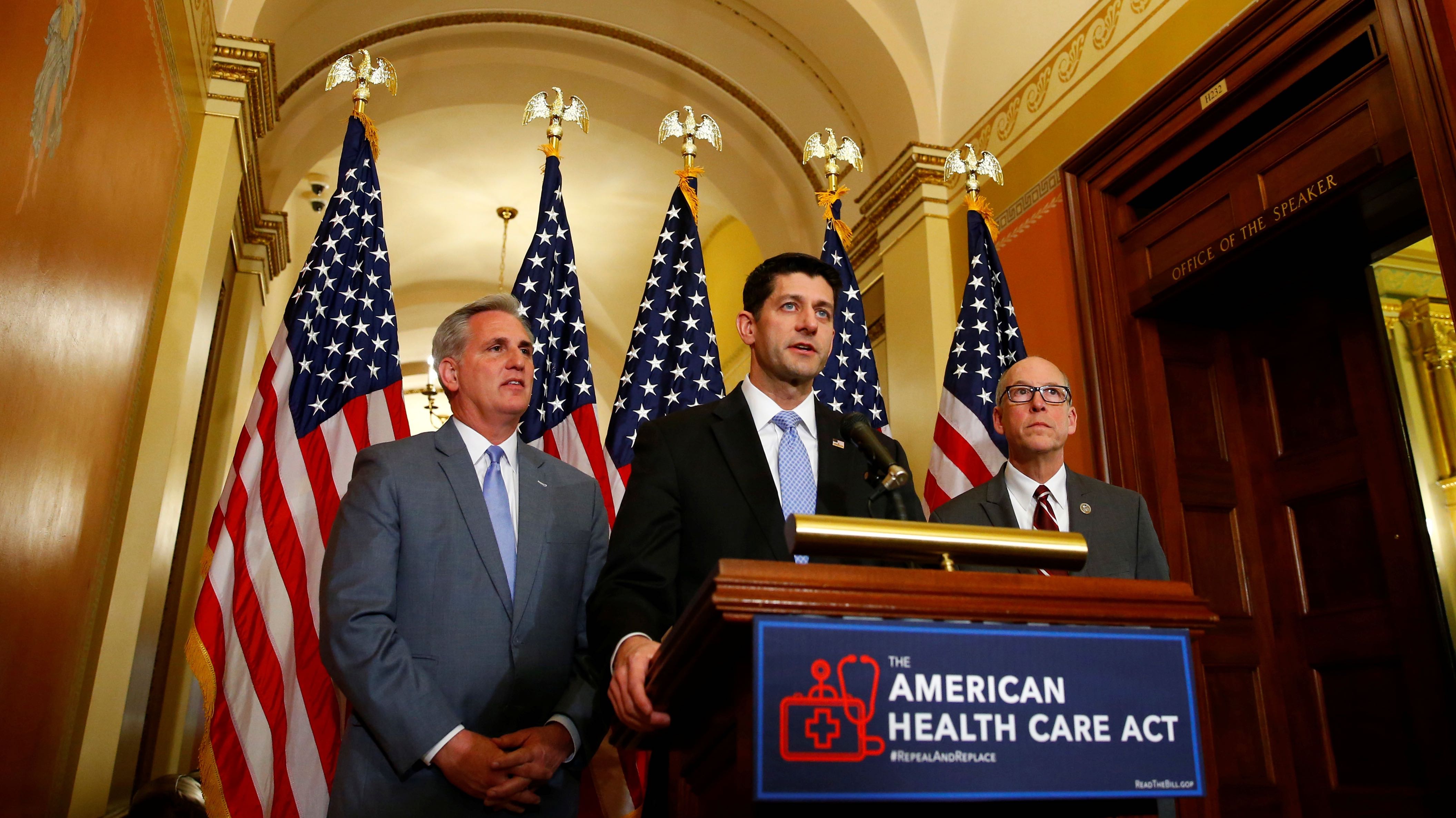

Trump’s plans for a replacement to the Affordable Care Act (also known as Obamacare) passed in the House on the afternoon of Thursday, May 4. This replacement, called the American Health Care Act, still requires Senate approval. However, if it passes in its current form and becomes law, there will be a number of significant cuts and changes to many people’s health care coverage. The most significant changes come for those who can’t afford comprehensive health care, those with pre-existing conditions and those who will choose to forego health care entirely. The most significant benefits of the American Health Care Act will come to upper-middle class and wealthier people without pre-existing conditions. Here’s the details of what you need to know:

- The elderly and individuals without disabilities living just above the poverty line will likely be most heavily impacted. A rollback on Medicaid expansions that previously gave healthcare to low-income childless individuals without disabilities under Obamacare means that most will no longer be covered. Alternatively, the costs for the insurance programs available to these individuals may become prohibitive, while the programs become less comprehensive and cover fewer health care costs. Either way, low-income individuals will likely become the largest category of people to become uninsured by the American Health Care Act. Meanwhile, older Americans could become charged nearly five times more than they previously paid for health care.

- Insurance companies could charge higher prices for worse coverage, especially in regards to pre-existing conditions. The American Health Care Act removes the rules implemented under Obamacare that required insurance companies to adhere to a minimum standard of quality and coverage and furthermore blocked insurance companies from charging more to those with pre-existing conditions. The list of pre-existing conditions that insurance companies could charge more for includes things like acne, AIDS, menstrual irregularities, pregnancy, cancer and many more.

- Wealthier individuals and families benefit most. The Act will remove two taxes on individuals earning more that $200,000 and couples earning more than $250,000. It would furthermore offer increased subsidies available for high-income people, while furthermore increasing the amount of money people are allowed to put into health care savings and flexible spending accounts. This primarily benefits those with a high enough income to be able to save money in this manner.

- Planned Parenthood will take a significant hit. With the current bill, Planned Parenthood will be barred from receiving any federal funding for a year. Furthermore, Planned Parenthood had previously relied heavily on Medicaid payments, which will now be reduced. The bill will also tighten rules that prevent health care plans that cover abortions from receiving federal subsidies in order to prevent federal funding from covering abortions.

Information for this article was gathering at NYTimes.com, CNN.com and NPR.org