America’s indifference towards financial corruption was why 2011’s Occupy Wall Street protests appeared ten years too late relative to the Great Financial Crisis (GFC). The Occupy movement came once the crisis was felt by Americans, but the reasons for the crash happened years earlier while everyone thought the economy was good. Proper insight into the financial sector was a necessary hedge against the crisis, but popular understanding was too little too late.

Other than Occupy Wall Street, most people remember the government’s $475 billion Troubled Asset Relief Program (TARP) bailout bill that helped to stabilize the economy. Tax payer money bailed out large companies. Unfortunately for the common American today, too big to fail and jail banks appear to be more insured against risk than before the GFC.

Despite popular press celebrating current economic growth, the Federal Reserve Board of Governors meeting on Friday, Sept. 1, ruled unanimously, finalizing “a new rule that should make it easier to wind down systemically important U.S. banks by creating a safe harbor for financial contracts after a firm defaults.”

“A memorandum accompanying the final rule said that the Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency would be adopting “substantively identical final rules […] in the near future that would apply to financial institutions under their purview.”

Provisions under Title II of the Dodd-Frank Act, passed in 2010, similarly act as hedges against financial risk in secondary markets. This general push to stabilize global financial entities and products came from the financial crash of 2008; the goal to back big banks from realizing insolvency, the inability to pay one’s debts, came from a “proposal sprang from a 2011 plan by the Financial Stability Board (FSB), an international standards-setting organization affiliated with the Group of 20 industrialized nations,” American Banker detailed.

As the Fed finalizes these protections against big bank default, it is simultaneously deciding when it’s going to start to sell off its massive GFC lifeboat called Quantitative Easing. A large sum of this life boat is composed of U.S. Treasury bonds that will be maturing (paid out to bondholders from the U.S. government) in 2018 and 2019.

The FSB’s telos is to stabilize global markets, which means avoiding contagion in those markets. In 2011, the FSB warned the United States Department of Justice to not criminally indict British bank HSBC on the basis of avoiding global financial contagion. HSBC was already caught funding billions of dollars to the Sinaloa and Norte del Valle drug cartels in Mexico and Colombia, respectively. The bank was fined 1.3 billion dollars but not criminally indicted under the Racketeer Influenced and Corrupt Organizations (RICO) Act.

Could this inaction be at least partially explained by corporate lobbying? Yes. Opensecrets.org, a project by The Center for Responsive Politics, notes “despite the mortgage and banking crises of 2008, the financial sector still managed to donate $468.8 million to federal campaigns and candidates during the 2008 election cycle”. They preface their page on the finance sector with “the financial sector is far and away the largest source of campaign contributions to federal candidates and parties”. Surprise? Big finance does primarily work in money itself.

Regardless of the government and its central bank’s recent liberal behavior towards bailouts, this policy finalization by the Fed’s Board of Governors is a far move from the Federal Reserve’s central bank duty as the lender of last resort. The Fed is now some eternal brace, consistently supporting the primary dealers or largest banks from disappearing through the traditional default. This new policy “forms part of global post-crisis efforts to end ‘too big to fail’ institutions that are so large and complex they could endanger the entire financial system if they fall into bankruptcy” Reuters said. However, is the Federal Reserve’s decision meant to end ‘too big to fail’ institutions or to perpetually solidify their existence with public funds?

Nonetheless, this trending bailout behavior now seeks legitimization through augmentation of the Federal Reserve’s institutional duties, while essentially foreshadowing volatile conditions in future financial markets and markets in general by extension.

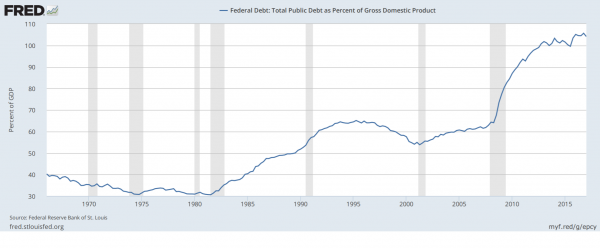

Before the GFC, money was made cheap to lend America out of the lull caused by the dot com bubble burst of 2000. It was that cheap money which showed its real cost later when “The Federal Reserve helped pull the U.S. economy from the brink of disaster [of the GFC] by purchasing vast quantities of government bonds and mortgage-backed securities” according to Bloomberg. This policy, Quantitative Easing (QE), kept the long term interest rates low for primary dealer banks to lend cheap money to Americans. The cost of cheap money policy pre-GFC was a post-GFC Federal Reserve Balance sheet of an unprecedented $4.5 trillion, the essence of the Quantitative Easing policy by the Federal Reserve. Low growth from the GFC and QE, the policy aimed at economic recovery, has kept rates near zero.

By raising the cost of the U.S. Treasury market, the Federal Reserve’s $4.5 trillion balance sheet funneled money into the markets to re-stimulate economic growth. Growth is nice, just not at the cost of long term stability and opportunity. In these conditions the means to stimulate growth nurtures bust and recession — this method of mixing moral hazard with the world’s finances is not sustainable. Nor is it sustainable to continue to ignore these coincidentally boring matters.

Glossary:

Great Financial Crisis: Started in 2007 by a historically gargantuan bubble in risky house mortgages and insurance, ultimately negatively affecting global markets.

Big Banks: The banks which are included in The Financial Stability Board’s list of systemically important financial institutions (ie. Goldman Sachs, Credit Suisse, Barclays, Bank of America ect).

Secondary Markets: The secondary market comes from the buying and selling of those products initially introduced directly from the borrowing institutions on the primary market; the Primary Market comes from institutions that want to obtain loaned money by selling bonds or stocks (governments and corporations). There are many kinds of secondary markets.

TARP: Troubled Asset Relief Program. A combination of programs to buy out all the defaulted home mortgages and corporate liabilities that went bad during The Great Financial Crisis.

Federal Reserve Board (FRB) of Governors: There are currently four members; Janet Yellen, Chairwoman, Stanley Fischer, Vice Chairman, Jerome H. Powell and Lael Brainard. The FRB decides the cost of US dollars relative to the health of the economy (monetary policy).

Moral Hazard

Increasing the risk of borrower default by lending more risky money to make more profit with the knowledge of risk protection against large scale borrower default and lending institution insolvency.

Information for this article was gathered from reuters.com, americanbanker.com, bloomberg.com, propublica.org, opensecrets.org, theguardian.com and fsb.org