Recent changes in the Free Application for Federal Student Aid (FAFSA) have made it easier for students to file for aid, but have also created drawbacks for families going through certain circumstances. Often the deciding factor for whether or not students attend college, financial aid is the crux of higher education. At New College, a school that prides itself on being a “best value” choice, the financial aid department works to ensure that students are provided with aid that best reflects their needs and financial situations.

How financial aid is determined

New College’s total cost of attendance is the combination of direct costs and variable costs. Direct costs consist of tuition and fees and room and board. Variable costs include transportation, books, supplies and “personal” costs.

“We build in about $4,700 for things like books, transportation to and from school, supplies–like if you need a laptop–and we create a budget,” Associate Director of Financial Aid Kim McCabe said.

For the 2017-2018 school year, costs of attendance were approximately as follows:

Florida Residents

Direct Costs: $16,180

Variable Costs: $4,470

Total Cost: $20,650

Out of State Residents

Direct Costs: $39,208

Variable Costs: $4,470

Total Cost: $43,678

Financial aid is awarded based on demonstrated need. FAFSA takes a student’s family income and calculates an approximate amount of money that the family can contribute. This value is called the Estimated Family Contribution (EFC) and is used by the college to determine how much aid is awarded.

“What we do with the FAFSA is we take the cost of attendance minus the EFC and we get need,” McCabe said.

For example, if a Florida resident’s EFC was $5,000, they would have $15,650 in need.

“We take that need and try to meet it from a variety of sources,” McCabe said. “So your New College scholarship gets figured into that, if you have Bright Futures, if you have any other state aid or any federal aid like a Pell Grant–all of those things get subtracted and we try to do our best to meet everyone’s need from those variety of sources.”

McCabe emphasized the importance of submitting the FAFSA on time, as students who do not file the FAFSA are not considered to have need.

FAFSA is also important for students who need to take out loans.

“You can’t take out any federal student loans if you haven’t filed a FAFSA. It really is a big tool, we deal with it quite a bit,” McCabe said.

Scholarships are awarded to students to help alleviate the cost of attendance.

“Here at New College, every student gets a scholarship,” McCabe said.

The amount of money obtained from the scholarships differs according to academic merit. Florida residents can receive an academic scholarship of either $1,000, $2,000, $2,500, $3,000 or $3,500 based on high school Grade Point Average (GPA) and standardized test scores. A calculator on the school’s website is available to determine which award correlates to the student’s GPA and Scholastic Assessment Test (SAT) scores. Every Florida resident receives at least a $1,000 academic scholarship.

Out of state students receive a $15,000 Presidential Scholarship.

After scholarships, grants, the EFC and other sources of funding are taken into consideration, the financial aid department determines the amount of aid to allocate to the student.

The New York Times published economic diversity records from colleges and universities around the nation. Because the median family income of a student from New College of Florida is $93,600, and 42 percent come from the top 20 percent, many students do not qualify for much aid.

For those who do qualify for large amounts of aid, there is a maximum amount that can be alloted.

“Nobody can get financial aid more than the cost of attendance,” McCabe said.

Changes in FAFSA

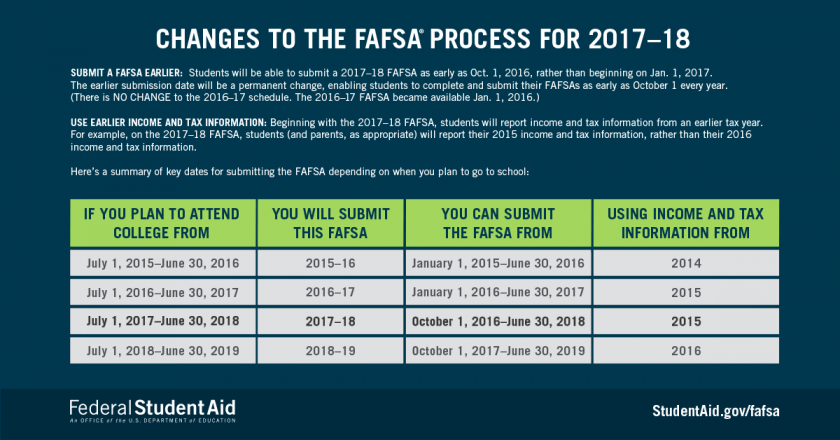

Starting with the 2017-2018 FAFSA, students now report earlier income information than previously necessary. This change was made by the Obama administration with the intent of making things easier for families contemplating first-time college attendance.

Those who submitted the 2016-2017 FAFSA were required to use 2015 income documents, reflecting money earned in the year prior. For the new 2017-2018 FAFSA, students were required to use 2015 income documents again, marking a shift from using documents one year prior to two years prior.

“The Department of Education changed it for two reasons. One; so many people didn’t have their taxes filed yet, so everybody was scrambling to meet the deadline to file the FAFSA, to find out their financial aid,” McCabe said. “But they also did it for incoming students, to give them more time to get their financial aid package and to make a better decision about where they want to go to college.”

This change grants students and their families more time to collect their tax information, but can also incorrectly reflect the financial situation that the family is in, as it fails to account for any circumstances that arose in the year prior.

Some of these circumstances, centered around changes in family finances, include job loss, involuntary reduction in wages, separation/divorce, the death of a spouse or parent, unusually high medical expenses and more.

To accommodate for these cases, there is a section on New College’s website entitled “Special Circumstances.” It can be found by going from the Admissions tab to the Cost and Aid tab and then from there to Special Circumstances.

On this page, students can find an “Income Adjustment” form, which allows them to report the changes.

“In many cases, the more that [your family income] goes down, we’re asking for both tax years,” McCabe said. “It has to be more than a $5,000 change in income for us to look at it because otherwise it doesn’t really make much of a difference.”

The financial aid department will not start reviewing the professional judgment requests until around January and February, which grants families the time necessary to obtain the most recent financial information documents.